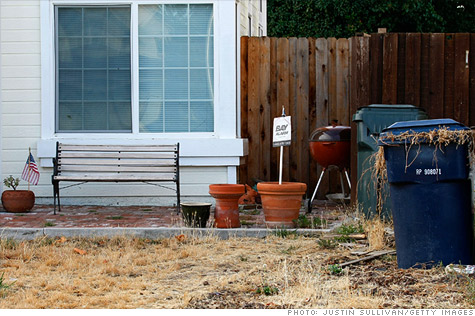

Flopping is the latest in mortgage fraud, in which sellers actually want as low a price as possible. Then an accomplice can flip the home for a big gain.

NEW YORK (CNNMoney) -- Why would anyone spread possum urine around a house, turn up the heat and close all the windows for a few days?

Because they're flopping, of course.

Flopping is the latest in mortgage fraud, in which sellers actually want as low a price as possible.

The scheme works if they are underwater on their mortgage, and their lender agrees to a short-sale, forgiving the difference between the sale price and the amount owed.

The seller unloads the home for the sandbagged price to an accomplice, who can then clean it up and flip it for a quick gain.

Suspicious short sales, ones flipped the same day, accounted for just under 2% of all short-sale transactions in 2011, according to CoreLogic (CLGX). Floppers averaged a 34% gain. The average profit: $55,000.

Related: Buy or rent? 10 major cities

Fraudsters can get away with it because banks are swamped with short sale requests -- they have more than tripled in the past three years.

The possum urine trick was an extreme example of the methods used to discourage homebuyers, said Ann Fulmer, a mortgage fraud specialist with Interthinx. "It smelled like a Hazmat site," she said.

Other tactics: Floppers pull out appliances and take cupboard doors off their hinges. They leave dirty laundry lying around and paint what looks like water damage on the ceilings. They might also invent plumbing or electrical problems, and give appraisers fake repair estimates created by cooperating contractors.

Related: Best places where homes are affordable

The sellers point out the flaws to legitimate shoppers, and when no one buys, the sellers have a convincing argument to make to the bank, according to Tim Coyle, director in the Financial Services division of LexisNexis Risk Solutions.

They can say: "Look, I've tried to move this property for six months and haven't been able to -- we need to lower the price," said Coyle. "They convince banks that the value of the property has deflated."

It can be hard to refute bogus damage claims without full investigations, according to Rob Hagberg, associate director of fraud investigation for Freddie Mac.

One flopping scam that relied on heavy repair estimates was repeated several times in the Ogden, Utah area. A group kept claiming houses had been contaminated with residue from crystal meth labs.

"It was the same cast of characters on multiple properties," said Hagberg.

Noticing the pattern, Freddie Mac investigated and broke up the ring.

The agency solicits help from the public to bust floppers and has a toll free number to report suspicious activity -- 1-800-4fraud8. ![]()

First Published: October 23, 2012: 6:22 AM ET

Anda sedang membaca artikel tentang

Latest in mortgage fraud: Flopping

Dengan url

http://ngopingeteh.blogspot.com/2012/10/latest-in-mortgage-fraud-flopping.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Latest in mortgage fraud: Flopping

namun jangan lupa untuk meletakkan link

Latest in mortgage fraud: Flopping

sebagai sumbernya

0 komentar:

Posting Komentar