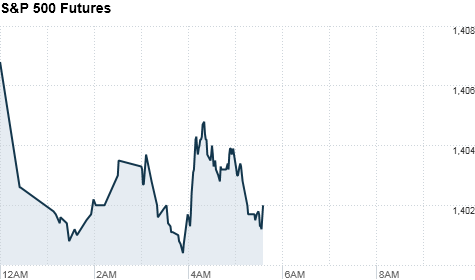

Click the chart for more premarket data.

NEW YORK (CNNMoney) -- U.S. stock markets have a bevy of corporate and economic data to sift through Thursday, as they continue to recover following the two-day suspension of trading due to Superstorm Sandy.

U.S. stock futures were lower.

The reports due before the start of trade include planned job cuts, private sector jobs and initial unemployment claims, in a prelude to the government's monthly jobs report on Friday.

Payroll processor ADP will release private-sector jobs data at 8:15 a.m. ET. The report is expected to show gains of 143,000 jobs in October, according to a survey of analysts by Briefing.com. Shortly afterward, the weekly initial jobless claims report is expected to total 375,000 new filings. That would be an increase from 369,000 in the prior week.

The other reports on tap for Thursday span a wide variety of economic sectors: nonfarm productivity, manufacturing, consumer confidence, construction spending and auto sales.

The corporate world is also busy Thursday: Exxon Mobil (XOM, Fortune 500)is scheduled to report its quarterly results in the morning, and both AIG (AIG, Fortune 500) and Starbucks (SBUX, Fortune 500) are due after the closing bell.

On Wednesday, as the markets reopened following a two-day closure due to Sandy, U.S. stocks ended a weak month on a mixed note,

Fear & Greed Index

World Markets: European stocks all ticked slightly higher in morning trade. Britain's FTSE 100 was up about 0.2%, while the DAX in Germany and France's CAC 40 were just above flat.

Asian markets closed higher. The Shanghai Composite had the strongest gains, up 1.7%, the Hang Seng in Hong Kong jumped 0.8%, and Japan's Nikkei rose 0.2%.

China's government reported earlier in the day that its official purchasing manager's index jumped to 50.2 in October, from 49.8 the previous month. Any reading above 50 indicates that factory conditions are improving in the manufacturing sector.

Currencies and commodities: The dollar gained against the euro and the Japanese yen, and it fell versus the British pound.

Oil for December delivery rose 0.2% to trade at $86.44 a barrel.

Gold futures for December delivery also rose slightly, to $1,723.10 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury edged lower, pushing the yield up to 1.7% from 1.69% late Wednesday. ![]()

First Published: November 1, 2012: 6:11 AM ET

Anda sedang membaca artikel tentang

Stocks set to slide ahead of economic reports

Dengan url

http://ngopingeteh.blogspot.com/2012/11/stocks-set-to-slide-ahead-of-economic.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks set to slide ahead of economic reports

namun jangan lupa untuk meletakkan link

Stocks set to slide ahead of economic reports

sebagai sumbernya

0 komentar:

Posting Komentar