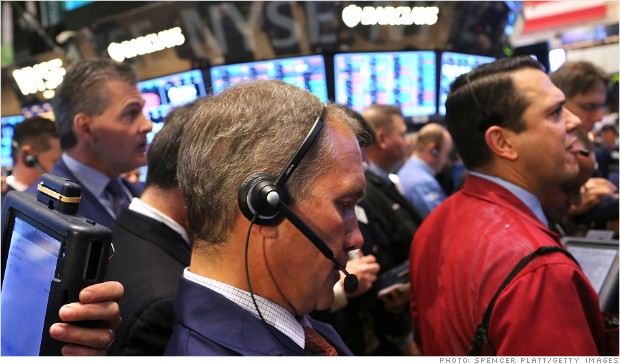

U.S. stocks finished slightly higher Monday.

NEW YORK (CNNMoney)

Investors have been reluctant to place big bets before lawmakers reach a compromise on tax increases and spending cuts set to kick in automatically on Jan. 1. Without a deal, the U.S. economy could fall back into a recession.

U.S. stock futures were little changed ahead of the opening bell.

The Fed meeting starts Tuesday, with options for further stimulus and new economic forecasts on the agenda. An announcement on interest rates is due Wednesday.

In other news, the Census Bureau will release data on the trade deficit and wholesale inventories for October on Tuesday, and discount retailer Dollar General (DG, Fortune 500) will report quarterly results.

The Treasury Department announced plans Monday to sell the last of its shares in bailed-out insurer AIG (AIG, Fortune 500). And HSBC said early Tuesday it will pay $1.92 billion to resolve money-laundering allegations.

Europe is also in the spotlight after Italian Prime Minister Mario Monti unexpectedly announced plans over the weekend to step down after parliament passes a national budget later this month. The news sent Italian stocks plunging and the yield on the Italian 10-year bond rising to nearly 5% Monday.

Fear & Greed Index

European markets edged higher in cautious morning trade. Greece is due to announce the results of a debt buyback later, triggering the disbursement of the next instalment of its EU-IMF bailout funds.

Asian markets ended mixed, with the Nikkei and Shanghai Composite losing ground. ![]()

First Published: December 11, 2012: 4:57 AM ET

Anda sedang membaca artikel tentang

Stocks: Eyes on Washington and the Fed

Dengan url

http://ngopingeteh.blogspot.com/2012/12/stocks-eyes-on-washington-and-fed.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Eyes on Washington and the Fed

namun jangan lupa untuk meletakkan link

Stocks: Eyes on Washington and the Fed

sebagai sumbernya

0 komentar:

Posting Komentar