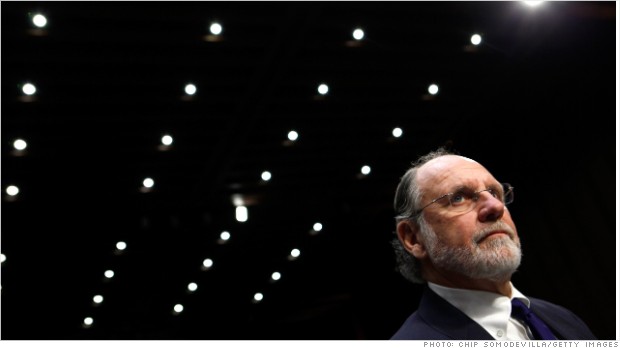

Jon Corzine's MF Global made billions of dollars worth of bets on risky European debt, sparking panic among investors.

HONG KONG (CNNMoney)

JPMorgan will pay $100 million to MF Global clients, according to the terms of the agreement. The trustee charged with liquidating the brokerage's assets will release another $417 million in funds that had previously been returned by the bank.

JPMorgan will also return a final $29 million in funds held by the bank after MF Global's stunning collapse and bankruptcy in late 2011.

The settlement, which still must be approved by the courts, should be one of the last major actions in the MF Global bankruptcy case. The trustee, James Giddens, has recovered a significant percentage of customer funds that were thought to be lost in the chaotic final days of the brokerage led by former New Jersey Gov. Jon Corzine.

JPMorgan (JPM, Fortune 500) was intimately linked to MF Global operations, especially in late 2011, acting as a clearing house for the brokerage while executing asset transfers between the firm and its clients.

The settlement should boost the recovery rate for MF Global customers in the United States to more than 93 cents on the dollar, according to Giddens. Foreign investors will now receive "several percentage points above" 75% to 82% of their original investment.

"This is a favorable and economically sound agreement ending what would have been a costly, protracted, and uncertain legal battle," Giddens said. "Without the agreement, additional substantial distributions would have been delayed for at least two or three years."

Representatives for JPMorgan did not immediately respond to requests for comment left outside normal business hours.

Related story: MF Global FAQ

In the wake of MF Global's collapse, regulators discovered that an estimated $1.6 billion was missing from accounts, setting off a global search for the misplaced funds.

About $105 billion in cash left the firm in its last week, Giddens has testified, as clients withdrew their funds and trading partners called for increased margin payments, leaving the firm scrambling to make good on its obligations.

Many of the clients left in a lurch were individual investors and farmers who used commodities contracts as part of their normal course of business.

It has since emerged that MF Global tapped customer funds for its own use during this crisis and failed to replace them, in violation of industry rules.

Corzine has consistently said he has no idea how the money went missing, never ordered that customer funds be misused and did not learn of the massive shortfall until less than 24 hours before the firm filed for bankruptcy.

In the commodities business, customer money at brokerages like MF Global is supposed to be protected at all times, even in the event of a bankruptcy.

No criminal case against Corzine and other top MF Global officials, long thought to be a possibility, has emerged. ![]()

First Published: March 20, 2013: 3:33 AM ET

Anda sedang membaca artikel tentang

JPMorgan agrees to $546 million settlement in MF Global dispute

Dengan url

http://ngopingeteh.blogspot.com/2013/03/jpmorgan-agrees-to-546-million.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

JPMorgan agrees to $546 million settlement in MF Global dispute

namun jangan lupa untuk meletakkan link

JPMorgan agrees to $546 million settlement in MF Global dispute

sebagai sumbernya

0 komentar:

Posting Komentar