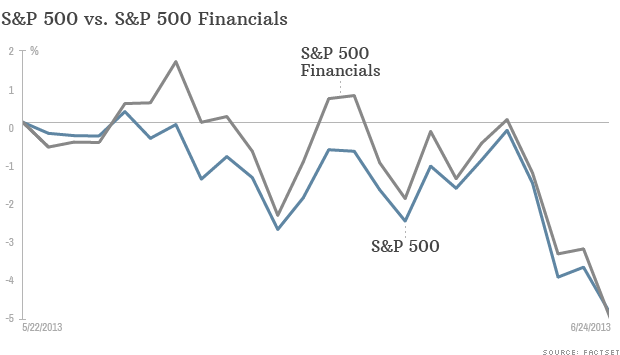

Ever since Bernanke hinted that the Fed may trim back on its bond purchase program, financial stocks have declined in line with the broader market, but their performance could begin to worsen.

NEW YORK (CNNMoney)

Financial stocks are the "single worst performers" during stock market corrections that are caused by shifts toward tighter Federal Reserve policies, according to Barry Knapp, chief equity strategist at Barclays.

Last week, Fed chief Ben Bernanke laid out the details about when and how quantitative easing would end.

The stock and bond markets have sold off sharply. Knapp said the pullback is likely to continue as investors adjust to the move towards more normal Fed monetary policy. And he believes history will repeat itself. Banks should suffer the most.

Ever since Bernanke first hinted last month that the Fed may trim back on its bond purchase program, Citigroup (C, Fortune 500) and Bank of America (BAC, Fortune 500) are down about 10% while the broader market is off about 4%.

Related: The bull is sleeping ... it's not dead

Knapp analyzed the performance of the broader market and individual sectors during the most recent periods when the Fed raised interest rates: 1983, 1994 and 2004. He noted that financials consistently lagged the broader market.

On average, financial stocks lose about 9% during Fed-induced corrections, about 1.5 percentage points more than the broader market.

Related: Bonds in the bargain bin

It makes sense for bank stocks to fall under severe pressure if the Fed is shifting its policy. After all, they have outperformed the overall market by such a wide margin. But the main reason banks get hit the hardest is because their business is "clearly sensitive to interest rates," said Knapp.

Although Bernanke has stressed that the Fed is likely to keep short-term rates low until 2015, long-term bond yields have surged as investors anticipate a slowing of asset purchases by the Fed. So Fed tapering is being viewed by investors as a form of tightening.

That's bad news because higher interest rates can lead to heavy losses in the bonds that the bank already holds.

And while the recovering housing market has been helping propel stocks higher, Knapp says it may not be strong enough continue supporting banks. Higher interest rates could trigger a spike in mortgage rates and slow the pace of new home loans.

The 30-year mortgage rate has already risen to nearly 4%, up from 3.35% at the start of May. While that is still low by historical standards, it's trimmed about $12,000 off of an average buyer's purchasing power.

Investors also seem to be worried that the Fed's decision to take away the "stimulus-filled punch bowl" is premature. It could punish the sectors that stand to gain the most from an economic recovery, such as financials.

Knapp is particularly worried about the banks this time around because even if the Fed is able to shift its monetary policy without denting the economy, the regulatory environment for banks remains cloudy.

Investors are still struggling to figure out how the implementation of new rules that were part of the Dodd-Frank reform law will impact banks. There are also calls for higher capital requirements for banks around the world. For those reasons, Knapp thinks investors should not have a huge position in financial stocks. ![]()

First Published: June 26, 2013: 5:53 AM ET

Anda sedang membaca artikel tentang

The Fed may kill bank stocks

Dengan url

http://ngopingeteh.blogspot.com/2013/06/the-fed-may-kill-bank-stocks.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

The Fed may kill bank stocks

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar