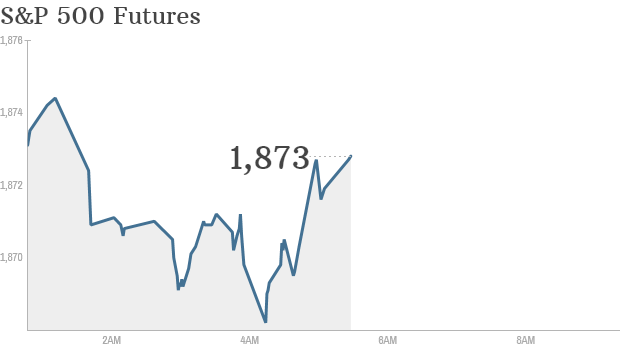

Click chart for in-depth premarket data.

NEW YORK (CNNMoney)

U.S. stock futures were pointing up and greed is still driving investors, according to CNNMoney's Fear & Greed index.

But some are becoming more cautious and are buying into gold -- a perceived safe-haven asset.

Gold prices have risen by nearly 8% over the past month amid market volatility, geopolitical uncertainty and concerns about a slowdown in China. Gold prices were rising by $2.50 an ounce early Thursday.

"The tone is one of an environment of rising caution, but no real fear," said Mike O'Rourke, chief market strategist at JonesTrading.

Related: Fear & Greed Index

Looking ahead to the economic news of the day, the U.S. government will publish weekly jobless claims numbers and February retail sales, both at 8:30 a.m. ET.

On the corporate side, Plug Power (PLUG) will report earnings before the bell. It's a highly speculative stock that's enjoyed a massive run as of late.

Aeropostale (ARO) will report earnings after the close.

U.S. stocks were little changed Wednesday. The Dow fell 12 points while the S&P 500 and Nasdaq edged higher.

Related: CNNMoney's Tech30

Both European and Asian stock markets were showing mixed results Thursday.

Worries about a slowdown in China -- the world's second largest economy -- spooked international investors Wednesday.

Economic data out on Thursday did little to reassure investors, raising further questions about China's growth rate.

"For China, the question is whether the [government] authorities are in control of the slowdown, or if it starts controlling them," said Simon Smith, chief economist at FxPro. ![]()

First Published: March 13, 2014: 6:27 AM ET

Anda sedang membaca artikel tentang

Stocks: Edging higher but caution remains

Dengan url

http://ngopingeteh.blogspot.com/2014/03/stocks-edging-higher-but-caution-remains.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Edging higher but caution remains

namun jangan lupa untuk meletakkan link

Stocks: Edging higher but caution remains

sebagai sumbernya

0 komentar:

Posting Komentar