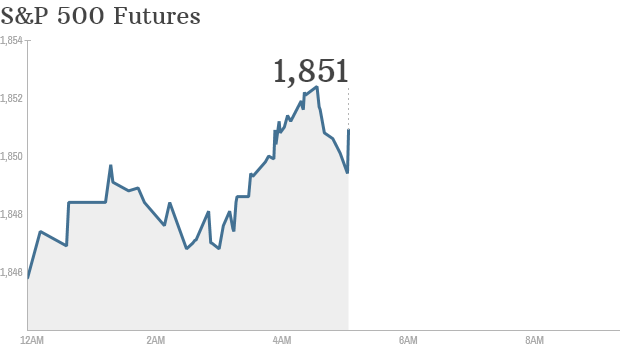

Click chart for in-depth premarket data.

NEW YORK (CNNMoney)

U.S. stock futures were looking soft Thursday morning, after Federal Reserve chair Janet Yellen warned Wednesday that the Fed stimulus program would most likely be finished by the fall and an interest rate hike could follow in early 2015.

U.S. stocks declined Wednesday after Yellen's remarks as investors were surprised by the possible timing of a rate hike.

The Dow Jones industrial average fell by more than 100 points, while the S&P 500 and Nasdaq also finished lower.

European markets were also moving down in morning trading, and Asian markets closed with losses.

"Market reaction was quite aggressive as new chair Yellen could have caught a few analysts off guard," said Investec foreign exchange specialist Jon Pryor. "This has been the most hawkish [Fed] announcement over the past few months."

Related: Fear & Greed Index

Looking ahead, the Federal Reserve is set to release bank stress test results Wednesday.

The U.S. government will also publish jobless claims at 8:30 a.m. ET and home sales from February will be reported at 10 a.m. ET.

Related: CNNMoney's Tech30

In corporate news, Burlington Stores (BURL) will report earnings before the opening bell. Nike (NKE, Fortune 500) will report after the bell.

Shares of Guess (GES) fell in after-hours trading after the company's revenue forecasts fell below analyst expectations. ![]()

First Published: March 20, 2014: 6:02 AM ET

Anda sedang membaca artikel tentang

Stocks: Fragile on U.S. rate hike talk

Dengan url

http://ngopingeteh.blogspot.com/2014/03/stocks-fragile-on-us-rate-hike-talk.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Fragile on U.S. rate hike talk

namun jangan lupa untuk meletakkan link

Stocks: Fragile on U.S. rate hike talk

sebagai sumbernya

0 komentar:

Posting Komentar