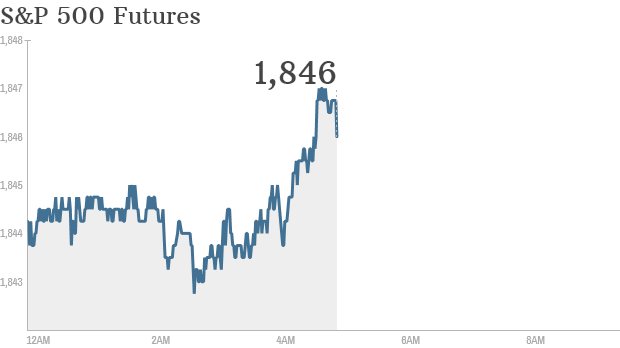

Click chart for in-depth premarket data.

NEW YORK (CNNMoney)

U.S. stock futures were all higher ahead of the opening bell.

The first three months of 2014 have been bumpy and it's possible all the major indexes could end the quarter in the red. The Dow Jones industrial average has declined by 1.9% since the start of the year. The Nasdaq is off by 0.6% and the S&P 500 is essentially flat over the same period.

A few economic reports and quarterly results scheduled for release Friday could affect market sentiment.

The U.S. government will publish personal income and spending data for February at 8:30 a.m. ET.

The University of Michigan will also be releasing it's consumer sentiment index at 9:55 a.m.

In corporate news, BlackBerry (BBRY) and Finish Line (FINL) will report earnings before the opening bell.

Shares in Blackberry have recovered by roughly 22% since the start of the year on hopes the company's CEO can revive the struggling smartphone maker. However, shares have declined over the past few days as investors worry about the company's turnaround plans and Societe Generale (SCGLF) downgraded the stock to "sell".

Related: Fear & Greed Index

U.S. stocks ended lower Thursday. The Dow was little changed, while the S&P 500 and Nasdaq ended in the red. Banks, especially Citigroup (C, Fortune 500), were among the biggest losers for the day.

European markets were up slightly in morning trading. The Dax in Germany advanced by 0.9%.

Most Asian markets closed out the trading day with gains, though the Shanghai Composite dipped by 0.2%. ![]()

First Published: March 28, 2014: 5:41 AM ET

Anda sedang membaca artikel tentang

Stocks: A strong end to a 'meh' March?

Dengan url

http://ngopingeteh.blogspot.com/2014/03/stocks-strong-end-to-meh-march.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: A strong end to a 'meh' March?

namun jangan lupa untuk meletakkan link

Stocks: A strong end to a 'meh' March?

sebagai sumbernya

0 komentar:

Posting Komentar