NEW YORK (CNNMoney)

Liquid alternative funds are akin to hedge funds for mom and pop investors. Instead of simply investing in stocks or bonds, these special funds use sophisticated techniques to bet on whether equities and bonds will move up or down. They also use borrowed money to amplify returns.

The idea is to generate steady, positive returns.

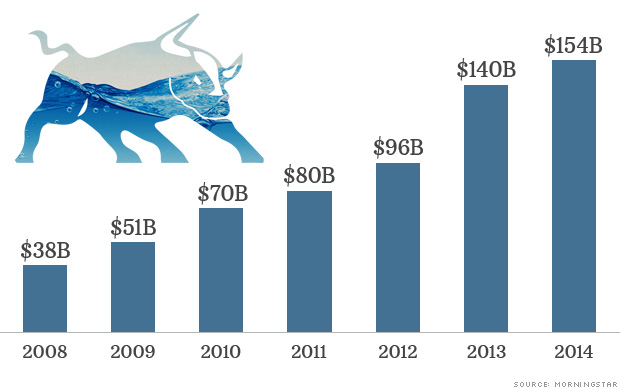

These funds have exploded in recent years. There are currently 455 liquid alternative funds with about $154 billion in assets, more than double the 217 funds that managed a mere $38 billion in 2008, according to data from Morningstar.

Benefits of liquid alternatives: Brian Kloss, who manages a $126 million bond-focused liquid alternative fund for Brandywine Global, believes that investors have flocked to these kinds of investments since the financial crisis because they aim to guard against the ups and downs of the broader market.

"When market valuations go to extremes, it's important to protect yourself," he says.

For example, unlike a conventional bond fund that will typically bet on rising bond prices, Kloss has the ability wager that they will fall. That approach, known in Wall Street parlance as "going short," served him particularly well during the European debt crisis, when he made a profit by shorting bonds of major U.S. investment banks that had significant exposure to Europe.

Related: Is Puerto Rico going to default?

Perhaps the most attractive aspect of liquid alternatives is that they are after all, liquid. That means investors can pull their money out at any time. That's in contrast to many high octane hedge funds and private equity firms that require so-called lockup periods in which investors can't redeem their money for a set period of time.

Higher fees: Still, there are many things to consider before diving into liquid alternatives. For one, they're more expensive than your classic mutual fund or ETF. The average minimum investment is around $6,000, Morningstar data shows. Of course, that's far less than the $500,000 that hedge funds with similar investment strategies often require investors to pony up.

Related: The unglamorous life of hedge fund startups

Then there are the fees. The average expense ratio for a liquid alternative fund is about 1.8%, but some go as high as 2.5%, according to Josh Charlson, director of alternatives strategy for Morningstar. That's compared to 1.31% for the average stock-focused mutual fund and 0.97% for the average bond fund.

The average ETF, which tracks an index or basket of stocks, has an equally weighted expense ratio of just .6%.

Performance should also be taken into account: While the S&P 500 has gained over 6% so far this year, liquid alternatives have returned a paltry 1.4%. In theory, liquid alternatives should do better when the market hits a snag.

"When markets are struggling, that's when you really want to outperform," Kloss asserts.

Charlson echoed that sentiment, and believes that record stock prices have actually had the effect of driving more investors into liquid alternatives.

"With the market having gone straight up for the last few years, there's more anxiety right now and I think investors are looking for ways to put protection into their portfolio," he says.

SEC concern: But while liquid alternatives have been successful in drawing interest from investors, they've also caught the attention of the Securities and Exchange Commission.

The agency lists alternative investment companies under its "heightened risk" examination priorities for this year. Specifically, it's looking at the funds' trading techniques, compliance staff, and marketing practices.

Charlson says it's not surprising that the SEC wants to take a closer look into liquid alternatives, but he doesn't foresee them finding any major widespread problems. He did however say that there could be instances in which start-up funds get in trouble for not having the right risk management systems in place.

He also warns that some fund managers are using the asset class' newfound popularity as a way to charge higher fees and increase revenue. Investors need to do their homework before dipping into the liquid alternative pool.

First Published: July 14, 2014: 4:13 AM ET

Anda sedang membaca artikel tentang

Wall Street's new happy hour: Liquid alts

Dengan url

http://ngopingeteh.blogspot.com/2014/07/wall-streets-new-happy-hour-liquid-alts_14.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Wall Street's new happy hour: Liquid alts

namun jangan lupa untuk meletakkan link

Wall Street's new happy hour: Liquid alts

sebagai sumbernya

0 komentar:

Posting Komentar