HONG KONG (CNNMoney)

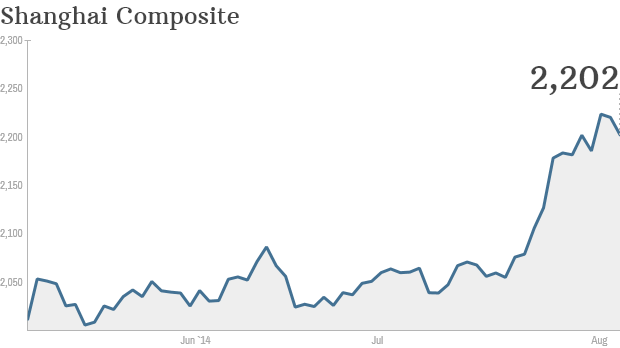

The benchmark Shanghai Composite has jumped about 7% since the end of June, erasing a 3.2% decline in the first six months of the year. The S&P 500 and the Dow Jones Industrial Average have both fallen around 2% since the end of June.

Analysts say investor sentiment in China is improving on the back of healthier economic growth spurred by government stimulus efforts.

"China's equity market has started to recover as a slew of mini-stimulus measures are beginning to have a positive impact on the economy," HSBC equity strategist Herald van der Linde said in a research note. Easy credit and low interest rates should also help support private investment and economic growth, he said.

In April, the Chinese government announced a slate of new spending initiatives on railway and urban redevelopment projects, along with a tax break for small businesses. Though small, experts say the measures helped boost a key manufacturing gauge to a 27-month high in July, and lifted economic expansion by a hair in the second quarter.

Related: China growth accelerates despite property worries

The recent bump is good news for Chinese stocks, which fell about 7% in 2013 and missed out on a global stocks rally.

Wells Fargo's Sameer Samana, however, warned that factors contributing to recent market optimism are temporary, raising the possibility of more pain for investors in China.

How long the recovery will last could hinge on what happens next with the government's anti-corruption drive. The campaign has already hit the luxury sector, and Nomura expects its impact to widen, limiting domestic consumption. If consumption falters, and the economy along with it, investors could be spooked.

The property market is also of concern. In a recent CNNMoney survey, eight out of 10 economists named the real estate sector as the biggest challenge to the economy. Given such worries, analysts at Credit Suisse say the government is likely to roll out more targeted stimulus to combat a property downturn.

Looking ahead, one unknown continues to linger. A pilot program to link the Hong Kong and Shanghai stock exchanges and open China's markets is scheduled to kick in soon, but it's still too early to determine the full impact on both bourses. Hong Kong's Hang Seng Index has jumped about 5% this year.

Unlike in Shanghai, stocks in Shenzhen have remained a bright spot, bucking regional trends. The underdog Shenzhen Composite has spiked 11% so far this year, after surging 20% last year.

First Published: August 6, 2014: 2:54 AM ET

Anda sedang membaca artikel tentang

China stocks are back from the dead

Dengan url

http://ngopingeteh.blogspot.com/2014/08/china-stocks-are-back-from-dead.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

China stocks are back from the dead

namun jangan lupa untuk meletakkan link

China stocks are back from the dead

sebagai sumbernya

0 komentar:

Posting Komentar