NEW YORK (CNNMoney)

These retail credit cards boast average annual percentage rates of 23.23%, according to a CreditCards.com analysis of cards from the 36 of the nation's biggest retailers.

That's more than eight percentage points higher than the average credit card APR of 15.03%.

Related: 5 things you can't buy with a credit card

"Retailers dangle incentives like 15% off a purchase to encourage consumers to sign up for their credit cards," said Matt Schulz, senior industry analyst at CreditCards.com. "[But] the much higher interest rates far outweigh the one-time discount for anyone who carries a balance."

If you're confident you will never miss a payment and you think the retailer's rewards program would provide you with savings, then it could be a fine deal. But if there's even a small chance you'll carry a balance, you could end up paying big money in interest as a result.

Related: 1 in 3 adults have debt in collections

Customers with a 23.23% APR credit card, for example, would be hit with $840 in interest if they carry a $1,000 balance and only make minimum monthly payments -- and it would take them 73 months to repay the balance. That compares to $396 in interest for the average credit card.

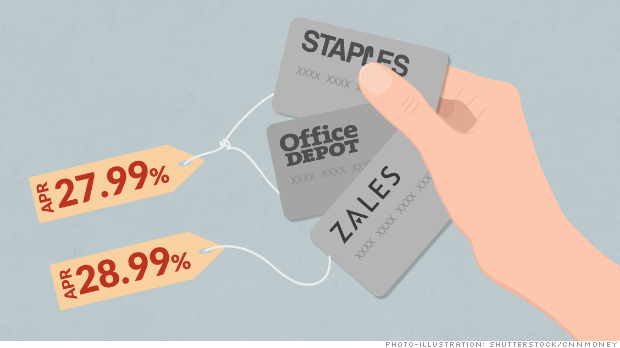

And some cards are much worse than others.

Jeweler Zales' store card topped the list, with a rate of up to 28.99%. Office Depot (ODP) and Staples (SPLS) both offer cards with rates as high as 27.99%, and Best Buy (BBY) credit cards come with rates ranging between 25.24% and 27.99% depending on your credit.

First Published: August 7, 2014: 12:18 AM ET

Anda sedang membaca artikel tentang

Shoppers beware: Retail credit card APRs average 23%

Dengan url

http://ngopingeteh.blogspot.com/2014/08/shoppers-beware-retail-credit-card-aprs_7.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Shoppers beware: Retail credit card APRs average 23%

namun jangan lupa untuk meletakkan link

Shoppers beware: Retail credit card APRs average 23%

sebagai sumbernya

0 komentar:

Posting Komentar