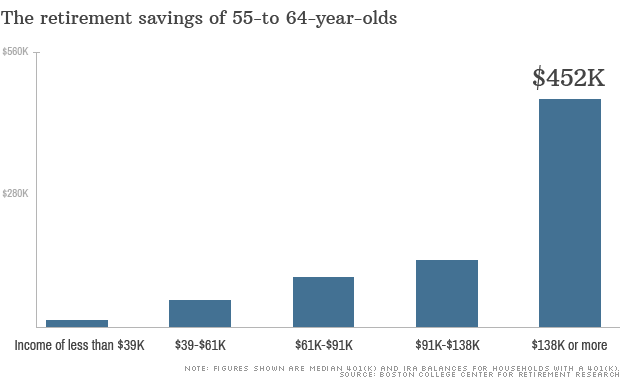

In 2013, households in the lowest income bracket had a median savings balance of just $13,000, while those in the top income bracket had median savings of $452,000.

In 2013, households in the lowest income bracket had a median savings balance of just $13,000, while those in the top income bracket had median savings of $452,000. NEW YORK (CNNMoney)

Last year, the typical 55- to 64-year-old household had just $111,000 saved in their 401(k)s and IRAs, which would translate into just $500 a month in retirement income, according to a report from Boston College's Center for Retirement Research that analyzed recent Federal Reserve data.

Related: Retired women: How I'm getting by

But when you break down the savings by income brackets, the numbers look even bleaker.

Households in the lowest income bracket -- those earning less than $39,000 a year -- had a median savings balance of just $13,000. Meanwhile, those in the top income bracket -- those earning $138,000 or more a year -- had a median of $452,000 saved.

And that's a gap that has widened significantly over the past decade.

America's wealthiest saw the value of their median retirement savings grow by 24% between 2004 and 2013, while low-income households couldn't even keep up with inflation as they watched their savings shrink by nearly 20%, according to the Federal Reserve's inflation-adjusted data.

Related: My biggest retirement mistake

Even more alarming: a growing number of low and middle-income households have no retirement savings at all.

Only 9% of the country's lowest income households and roughly half of middle-class families have a retirement savings account, compared to more than 90% of the country's wealthiest households, the Federal Reserve found.

Alicia Munnell, who wrote the Boston College report, said the "depressing" savings levels and rates could be a reflection of stagnant wages and lingering effects of the recession.

According to Munnell, there are ways to help workers save more for retirement, including requiring employers to auto-enroll workers into a retirement plan and increasing the rate at which employers enroll their workers.

Other factors that she says must be addressed include high fees and when savers cash-out of their 401(k)s.

"(Something's) going to have to change," she said. "The question is, 'How long is it going to take?'"

First Published: September 18, 2014: 7:02 PM ET

Anda sedang membaca artikel tentang

Retirement savings gap widens between rich and poor

Dengan url

http://ngopingeteh.blogspot.com/2014/09/retirement-savings-gap-widens-between.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Retirement savings gap widens between rich and poor

namun jangan lupa untuk meletakkan link

Retirement savings gap widens between rich and poor

sebagai sumbernya

0 komentar:

Posting Komentar