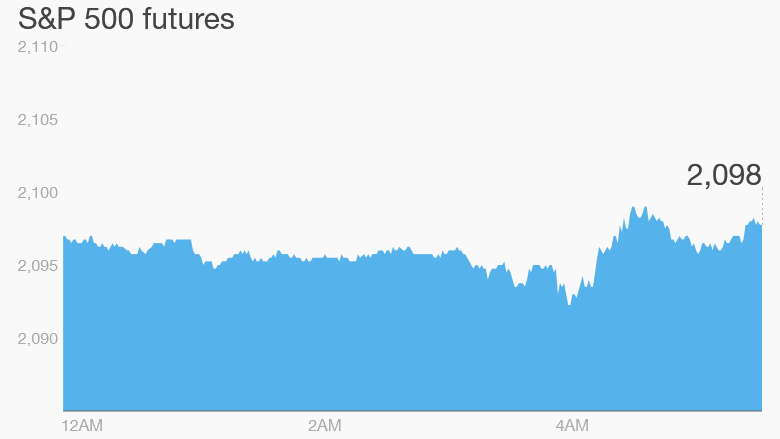

Click chart for in-depth premarket data.

Click chart for in-depth premarket data. Here are the six things you need to know before the opening bell rings in New York:

1. China slowing, Europe recovering: New data shows China's factory activity slumped this month, dropping to its lowest pace in almost a year. The HSBC report is "the latest in a string of disappointing data out of China," according to economist Julian Evans-Pritchard of Capital Economics. It has sparked talk of more stimulus by the Chinese government and central bank.

Similar data from the eurozone shows business activity in the region is growing by the most in nearly four years. Traders reacted by bidding up the euro.

2. Stock market overview: U.S. stock futures are edging higher Tuesday and most major European markets are pushing up in early trading.

Asian markets ended with mixed results. In China, the Shanghai Composite index inched up by 0.1% after taking a knock earlier in the day. In Hong Kong, the Hang Seng dipped by 0.4%.

Related: Fear & Greed Index

3. Potential market movers -- Big banks, Facebook: The banking sector has some strength behind it this morning. Shares in Goldman Sachs (GS) and Bank of America (BAC) are pushing forward in premarket trading. Both are up by more than 1%.

Shares in Facebook (FB, Tech30) could be on the move Tuesday after the New York Times reported that the social media giant plans to host news websites' content directly on its pages, allowing users to read stories on Facebook instead of clicking through to external sites.

4. It's all about inflation: The U.S. Bureau of Labor Statistics will release inflation data for February at 8:30 a.m. ET.

In the U.K., inflation data released Tuesday showed consumer prices were unchanged in February compared to the same time last year.

"U.K. inflation has fallen to zero for the first time on record," said Chris Williamson, chief economist at Markit. "Rather than being a concern, the drop in inflation is a boon to the economy, providing households with greater spending power at a time when pay growth remains frustratingly weak."

5. Greek drama continues: Reports are swirling that Greece will submit a detailed list of economic reform proposals by Monday to its international lenders in a bid to secure the cash it needs to pay its bills.

Greece will run out of funds, and could drop out of the euro, if it fails to convince Europe to release the remainder of its mammoth 240 billion euro ($262 billion) bailout.

Related: CNNMoney's Tech30

6. Monday market recap: It was a subdued day in the markets on Monday.

The Dow Jones industrial average dipped by about 12 points. The S&P 500 closed 0.2% lower and the Nasdaq slid 0.3%.

CNNMoney (London) March 24, 2015: 6:24 AM ET

Anda sedang membaca artikel tentang

Stocks: 6 things to know before the open

Dengan url

http://ngopingeteh.blogspot.com/2015/03/stocks-6-things-to-know-before-open_24.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: 6 things to know before the open

namun jangan lupa untuk meletakkan link

Stocks: 6 things to know before the open

sebagai sumbernya

0 komentar:

Posting Komentar