NEW YORK (CNNMoney)

The Coolest Cooler (yes, a cooler) raised $13.3 million in its 52-day run. The previous record holder, the Pebble smartwatch raised $10.2 million in 2012.

Why have more than 60,000 people contributed to a cooler campaign?

Well, this cooler includes a blender, waterproof bluetooth speaker, USB charger, cutting board and bottle opener -- a "portable party," according to founder Ryan Grepper of Portland, Ore.

And those who pledged enough ($165 or more) will save at least $130 on the cooler, which will retail for $299.

Those who contributed less can still get in on a piece of Kickstarter history: A $25 contribution earned a Coolest-branded reusable party cup and a drink guide; for $55, backers receive the party cup plus a "Keep Calm and Blend On" tee.

And for the first eight backers who contributed $2,000, Grepper will fly out and help them host a tailgate party with the Coolest (before its available to backers in February 2015).

Related: The 13 most WTF gadgets

The record is impressive by any measure, but the last couple days have been a whirlwind: Backers contributed over $2 million in 24 hours.

The rush to contribute in the final days isn't all that shocking to Jason Greenberg, PhD and assistant professor at New York University's business school.

"This is something we tend to see in cultural settings where the 'rich get increasingly richer,'" said Greenberg. "A firm end date and time can precipitate this."

But it adds more pressure to satisfy consumer expectations.

"Bigger capital raises entail bigger expectations and scrutiny," said Greenberg.

Grepper is acutely aware of this obligation.

"I feel personal responsibility to each backer that has supported me and am committed making the Coolest live up to its name," said Grepper.

Related: Water balloon lovers pledge $645,000 on Kickstarter

The success of the Coolest is perhaps all the more surprising because this isn't its first time around the Kickstarter block.

Grepper unsuccessfully tried to raise $125,000 for similar model In November 2013 (he only earned $100,000),

"My confidence was pretty low because of the first campaign," said Grepper.

But a combination of seasonality (launching the campaign in July vs. November), more supporters and an improved design helped him get far more than his $50,000 goal this time around.

Setting the bar so low -- and meeting it within 36 hours of launching -- has helped him get ahead on production. He's currently in the process of locking in a final design and securing a factory to produce the coolers (which will be available in three colors: Margarita, Blue Moon and Coolest Orange).

Related: These startup ideas are money magnets

So, are the millions raised any indication of how it'll fare post-crowdfunding?

They could be.

"We've seen more and more angels and investors using [Kickstarter] as a minor league in terms of [gauging] customer demands," said Greenberg.

Grepper said he's already been contacted by "many" retailers who are interested in working with him to sell the product.

According to PrivCo, a financial data provider on privately-held companies, U.S. cooler sales totaled $635 million in 2013.

Igloo Products Corp "dominates" the market, according to Matt Turlip, senior analyst at PrivCo. The company, which ACON Investments bought from J.H. Whitney & Co. earlier this year, owns 53% of the full-size cooler market.

"Maybe in a year or two, the Coolest can hope to compete," said Turlip.

First Published: August 29, 2014: 9:19 PM ET

Vice's co-founder Shane Smith has said he wants Vice to be the "next CNN" and "next MTV."

Vice's co-founder Shane Smith has said he wants Vice to be the "next CNN" and "next MTV."

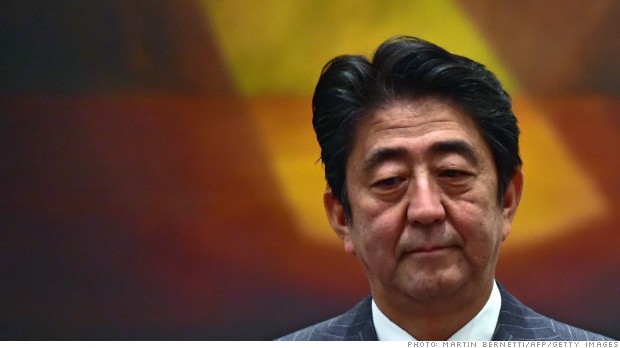

Prime Minister Shinzo Abe must make more progress on structural economic reforms.

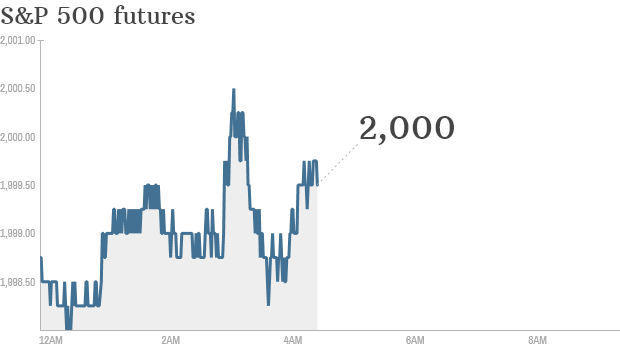

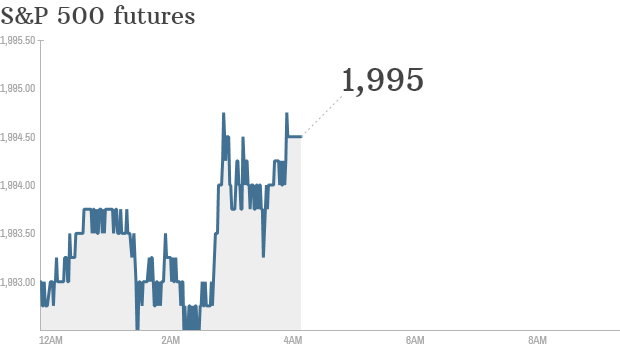

Prime Minister Shinzo Abe must make more progress on structural economic reforms.  Click chart for in-depth premarket data.

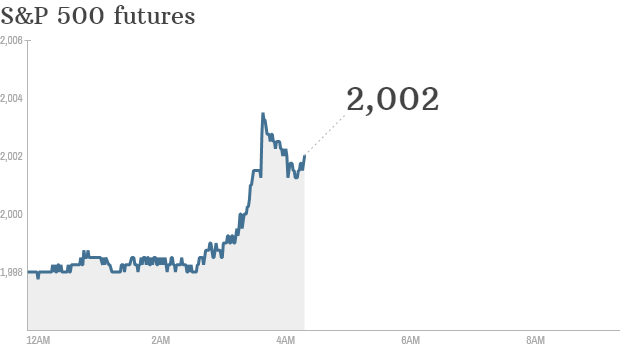

Click chart for in-depth premarket data.  The first tweet from @JPMorganCEO on August 27.

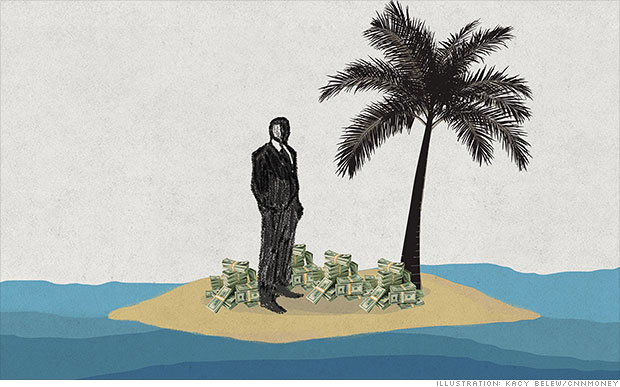

The first tweet from @JPMorganCEO on August 27.  Companies like Apple that do business abroad can delay paying U.S. taxes on the billions of dollars they keep offshore, indefinitely.

Companies like Apple that do business abroad can delay paying U.S. taxes on the billions of dollars they keep offshore, indefinitely.

American Express and Discover tied for first place in customer satisfaction this year.

American Express and Discover tied for first place in customer satisfaction this year.  The government said the recalled chargers look like this and are stamped with the code "LS-15."

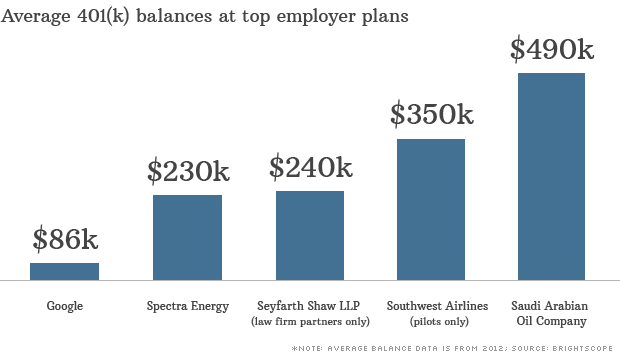

The government said the recalled chargers look like this and are stamped with the code "LS-15."  These five 401(k)s are among the top employer plans offered to workers in the tech, utility, legal, airline and oil and gas industries.

These five 401(k)s are among the top employer plans offered to workers in the tech, utility, legal, airline and oil and gas industries.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Rifles are a tough sell for Smith & Wesson.

Rifles are a tough sell for Smith & Wesson.

Ken Feinberg has received 100 death claims so far.

Ken Feinberg has received 100 death claims so far.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Don't click on that "cutest thing ever" link! Facebook wants to discourage "click-bait"

Don't click on that "cutest thing ever" link! Facebook wants to discourage "click-bait"  Burger King is in talks that could move the restaurant chain's headquarters to Canada.

Burger King is in talks that could move the restaurant chain's headquarters to Canada.  The "Lizard Squad" has targeted Sony's online gaming network.

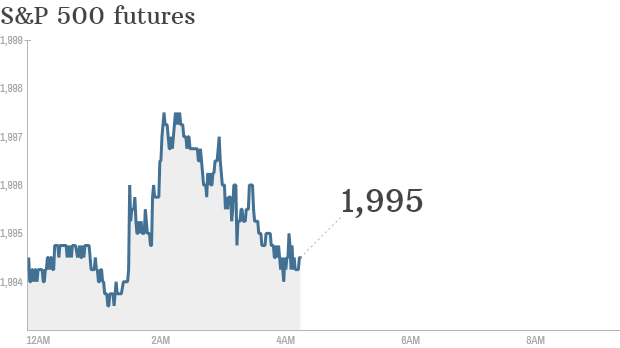

The "Lizard Squad" has targeted Sony's online gaming network.  Click chart for in-depth premarket data.

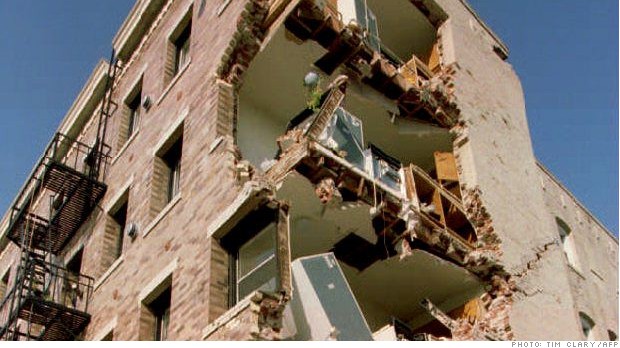

Click chart for in-depth premarket data.  Sunday morning's earthquake jolted Northern California, leaving extensive and widespread damage.

Sunday morning's earthquake jolted Northern California, leaving extensive and widespread damage.  Buildings crumbled in the 1994 Northridge earthquake, rated the most expensive in U.S. history.

Buildings crumbled in the 1994 Northridge earthquake, rated the most expensive in U.S. history.