NEW YORK (CNNMoney)

For instance, when you're asked to "strategerize a greenfielded, collaborative solution that considers the equities of all stakeholders" you may think you should do something eco-friendly.

But you'd be wrong.

According to one CNNMoney reader from Alexandria, Va., who was asked to do this very thing, what you're really supposed to do is just work with everyone on your project to come up with a solution.

Or consider the role of peanut butter. Unless you work for Skippy, you may wonder what it has to do with anyone's job. But if you ask the numbers guys in your division, they may talk about how "we peanut bread spread the dollars across all segments."

The real meaning? We allocated money to every department (or region or category of expense), according to another reader, who works in the insurance industry.

Linguist Geoffrey Nunberg, who teaches at University of California, Berkeley's School of Information, equates corporate jargon with high school slang -- the kind teenagers use to sound like they belong.

"Using it marks you as an insider," Nunberg said.

Plain English seems to be in particularly short supply when there's potential to scare the pants off the rank-and-file.

Quiz: Are you a corporate jargon junkie?

One reader got word that management planned "to leverage internal efficiencies by enlisting external resources, thus driving a reduction in operating costs, thereby enhancing shareholder value."

Translation: Layoffs are coming. That way we can promise to reduce our operating costs, which Wall Street loves! But don't worry -- we'll outsource the old jobs to an outside firm, which may even hire the very same folks who get pink-slipped!

"Good thing no one ever asked how much money we saved, because the answer was none. Our operating costs actually went up," said a CNNMoney reader in Sarasota, Fla., who worked at a company that promised to "leverage" and "enhance"

That may help explain why outsourcing is such big business. An invitation to an industry conference about the practice promised to "have one foot planted in the reality of present day, and the other in the future, so we can develop a realistic roadmap for crossing this chasm from today's tactical efficiency to our utopia of achieving genuine business value and alignment between business operations and corporate objectives."

Plain-English translation: No idea. But utopia sounds nice.

Related: Workaholism: Regain balance before you burn out

Judging from the slew of submissions from CNNMoney readers, there's a long list of words and definitions that you need to know to be an insider these days. Here are 10 of our favorites:

Ideation session: Sure, you could just say you're having a meeting to come up with good ideas for a new project. But why not hold an ideation session to action plan a strategy?

Collabition: Word mash-ups can be fun. Or they can make you cringe. Exhibit A: collabition, an ill-conceived merger of "collaboration" and "competition." It's a close cousin, of course, to coopetition (cooperation + competition).

Onboard: Training new employees is essential. So is persuading colleagues why your proposal is a good one. But "onboarding" them makes it seem so much more ... sporty?

Rightsize: Getting rid of workers sounds like a such a downer. Why not keep things upbeat and say you're "rightsizing" the company.

Decisioning: Making a decision. Really, why is that so hard to say?

Parking lot: When you don't want to talk about something -- say when you're running a meeting and get caught short by a question -- you might say "let's put that in the parking lot."

Level set: When someone says, "let's level set" or "we need to level set with the group" it's akin to saying "we should get together to figure it out."

Unsuck-it.com, which deciphers business jargon, offers another definition: to agree on expectations.

Or you can use it to postpone dealing with something unpleasant, such as when someone questions the wisdom of what someone else says. "Once that phrase gets pulled [in a] meeting, the glaring disagreement is kicked along to be dealt with later," said one reader.

Cadence: Who says marching band has to end when you leave school?

When you're in sales, you might call clients once a month to make sure they're happy. But apparently it sounds much better to tell your team to "establish a regular cadence of outreach with our clients to ensure we are delivering value," a reader wrote.

Updation: Merely an awkward way to say "update." A reader from North Carolina said it began as a joking term when his company was developing its current operating system. Now it actually appears in the operating system as an "action description."

Open/ing the kimono: To reveal or be transparent about something. Several readers nominated this as a contender for all-time worst corporate jargon. Agreed.

Said one reader: "I end up visualizing whoever said it and I really don't want to .... Plus, in my experience, the person then proceeds to lie, which makes the phrase even more abhorrent."

First Published: October 26, 2014: 3:38 PM ET

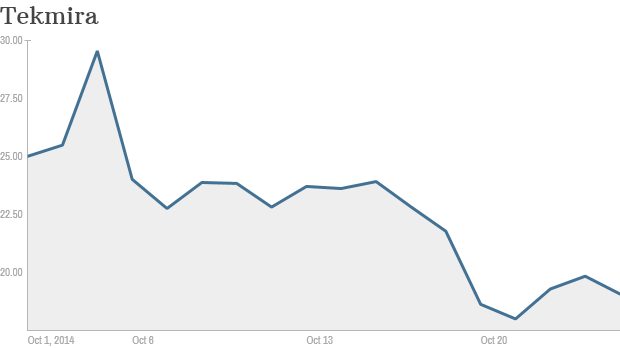

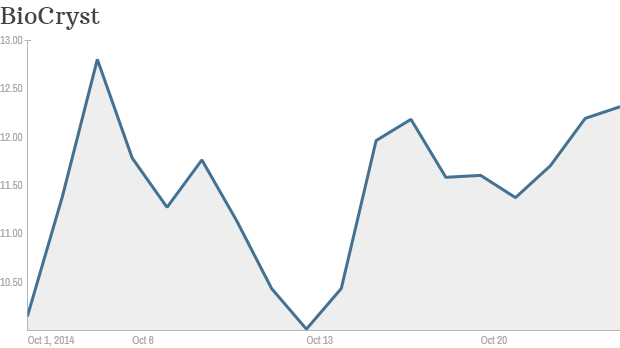

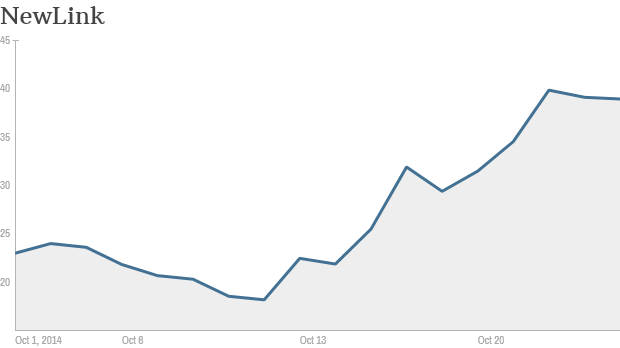

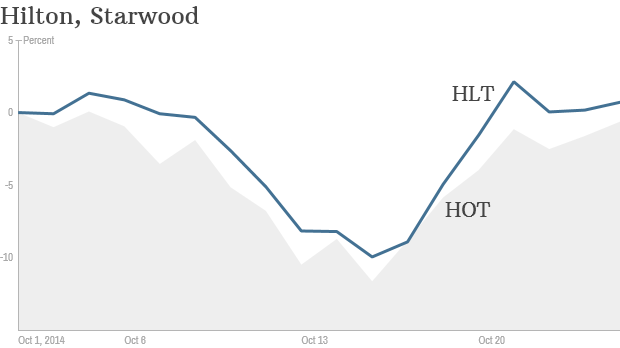

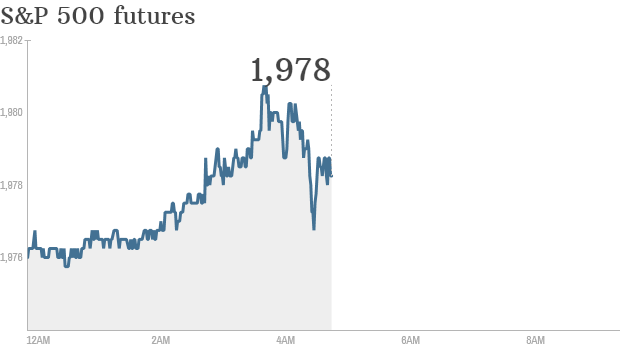

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Graduates cheer during the Bowie State University graduation ceremony in May 2013.

Graduates cheer during the Bowie State University graduation ceremony in May 2013.

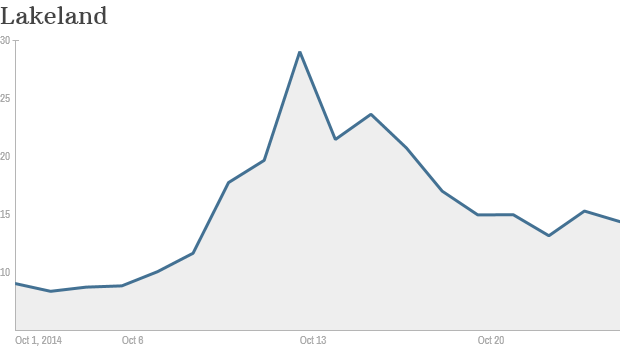

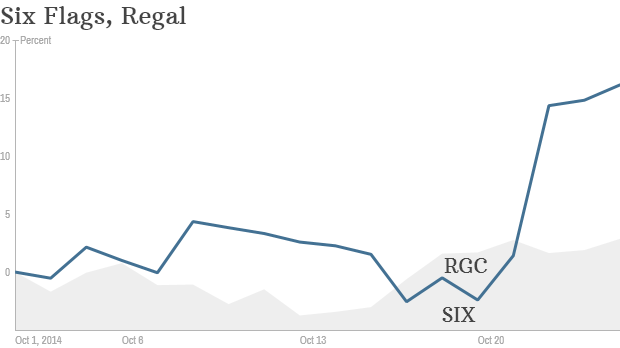

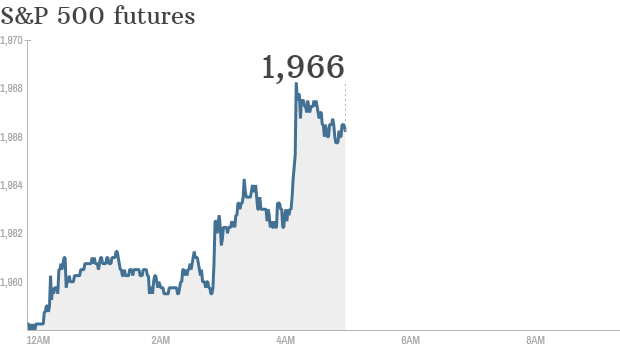

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Illinois Gov. Pat Quinn, a Democrat, is running for re-election and backs a non-binding ballot measure that would impose a millionaire tax to help support schools.

Illinois Gov. Pat Quinn, a Democrat, is running for re-election and backs a non-binding ballot measure that would impose a millionaire tax to help support schools.  Apple VP says company quickly fixed iOS bug.

Apple VP says company quickly fixed iOS bug.  A big logo created from pictures of Facebook users worldwide is pictured at a company data center in Sweden.

A big logo created from pictures of Facebook users worldwide is pictured at a company data center in Sweden.

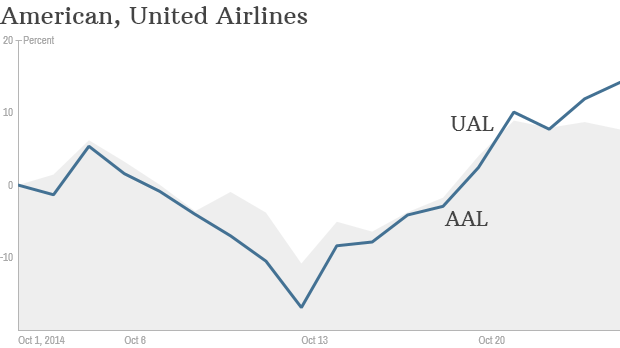

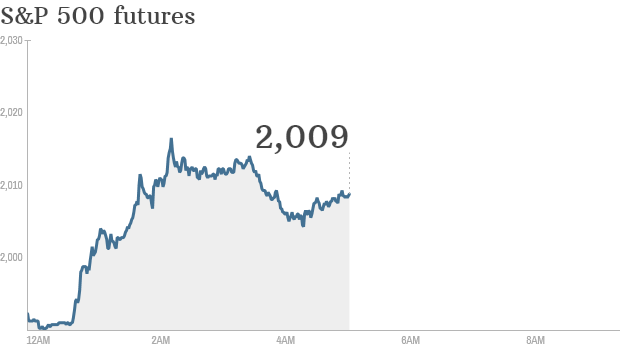

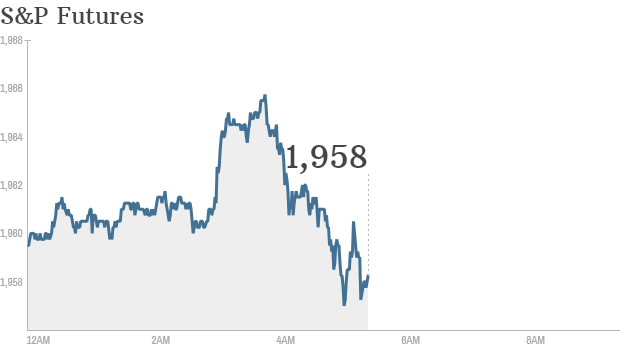

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Musician Eric Clapton helped design this original Ferrari. It's one of a kind and estimated to be worth millions.

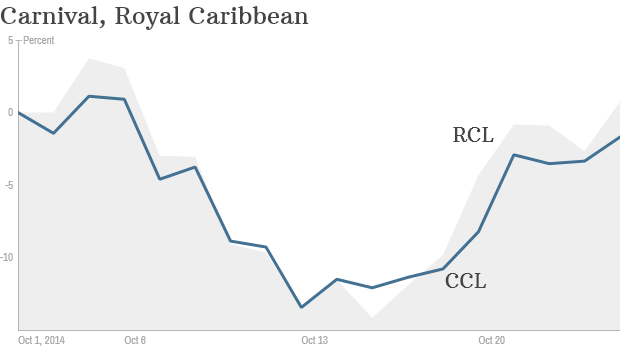

Musician Eric Clapton helped design this original Ferrari. It's one of a kind and estimated to be worth millions.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

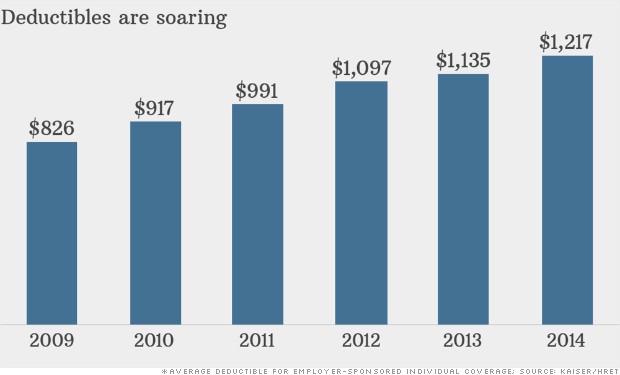

Medical care has become more costly for the Vance family under a high-deductible plan.

Medical care has become more costly for the Vance family under a high-deductible plan.