Stocks have been having a pretty bad 2015 so far.

Stocks have been having a pretty bad 2015 so far. NEW YORK (CNNMoney)

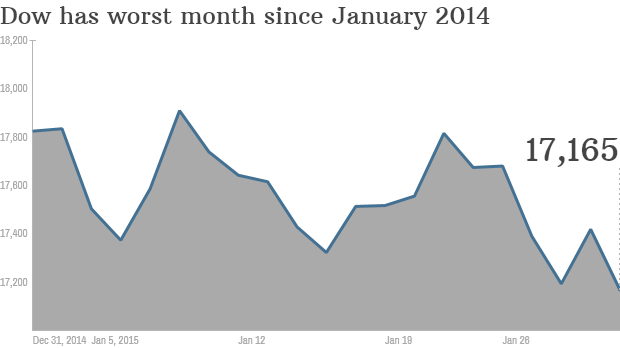

The Dow shed 3.7%, the S&P 500 has lost 3.1%, and the Nasdaq is over 2.1% lower.

Talk about a bad start to the year. A quick glance at the chart below shows what a whiplash ride 2015 has been so far with 7 days where the market swung up or down more than 200 points.

Related: Bears warn: A crisis could be near

There's an adage on Wall Street that the early days of the year are a good predictor of the full-year. Historically speaking, there's only about a 50-50 probability that the stock market will end the year on a positive note if January saw market declines, according to the Stock Trader's Almanac.

Dan Greenhaus, chief strategist at BTIG, points out that five of the last six down January's (2003, 2005, 2009, 2010, 2014) have not prevented the S&P 500 from finishing higher for the full year.

The one exception was 2008, but that was the year of the financial crisis.

But investors might take comfort that January of 2014 was even worse and stocks rebounded significantly to hit record highs in December.

"In an effort to note something positive we can say that while the [S&P 500] index is down [3]% or so this year, the index finished January 2014 down by 3.6%!" Greenhaus wrote in a recent research note.

This time last year the market was worried about an emerging markets meltdown and the impact of the Federal Reserve pullback on so-called quantitative easing (aka bond buying). Those fears are mostly gone. This January investors are worried about cheap oil and the global economic slowdown.

The energy and financial sectors were the biggest losers for the month. Energy is easy to understand. Oil fell below $50 for first time in early January and acted as a psychological trigger that spooked investors. This was followed up by earnings reports and announcements from Big Oil showing major cutbacks in spending and operations. There's little doubt that it will be a leaner year ahead in the energy sector.

Related: America's No. 2 oil company cuts spending

Financials were a bigger surprise. The big bank CEOs blamed Washington regulations for sluggish performance, but the reality is many bank's core investment banking and trading have been suffering.

There was one bright spot in January: Bonds.

As the stock market gyrates, investors have been fleeing to bonds. Several European nations even have negative yields on their bonds, a sign of just how much demand there is for a so-called safe asset.

In the U.S., the 10-year government bond yield is now down to 1.66%, the lowest point since the spring of 2013.

First Published: January 30, 2015: 3:54 PM ET

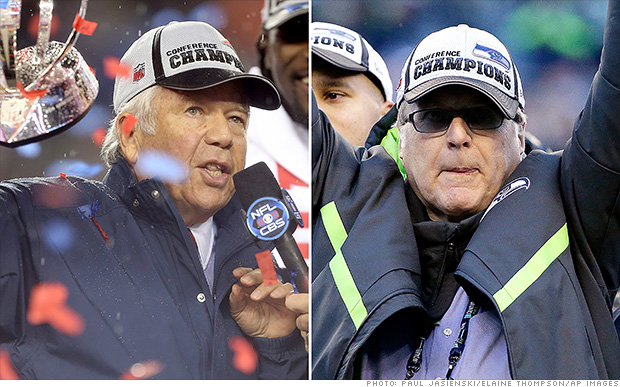

Bob Kraft, left, and Paul Allen, right, owners of the two Super Bowl teams, made their fortunes in very different ways.

Bob Kraft, left, and Paul Allen, right, owners of the two Super Bowl teams, made their fortunes in very different ways.

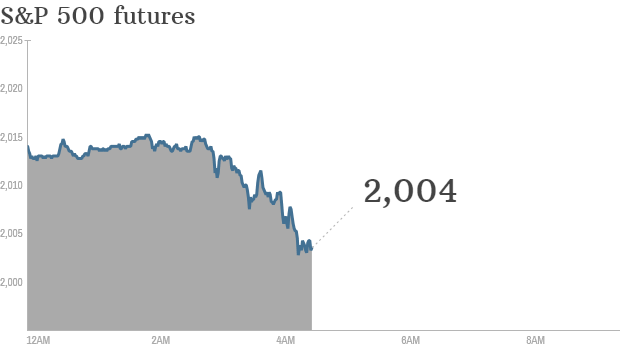

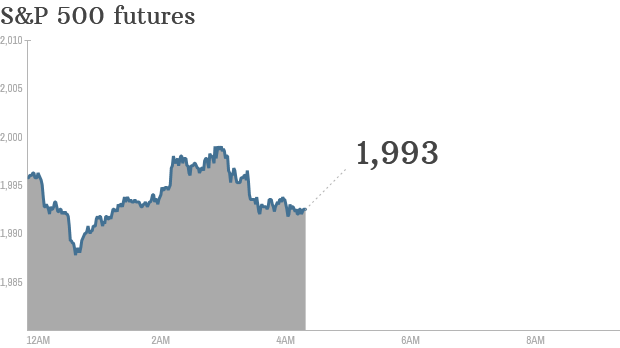

Click on chart for more premarket data.

Click on chart for more premarket data.  Newsweek's much-discussed Bible issue was its best seller of 2014.

Newsweek's much-discussed Bible issue was its best seller of 2014.

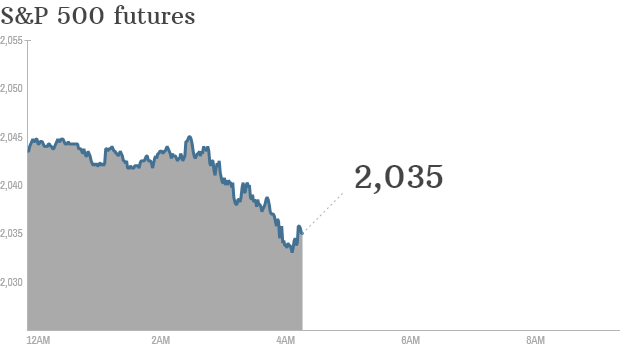

Click chart for in-depth premarket data.

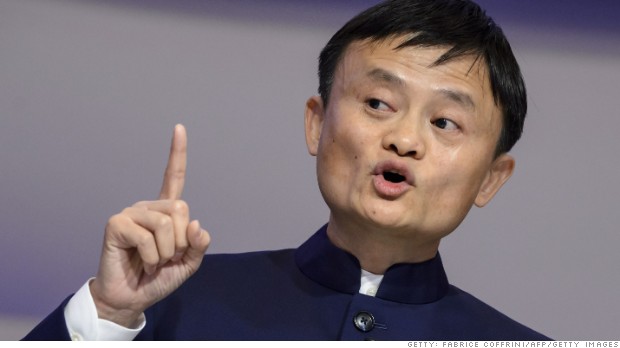

Click chart for in-depth premarket data.  Alibaba co-founder Jack Ma has called counterfeits a "cancer."

Alibaba co-founder Jack Ma has called counterfeits a "cancer."  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  China is boosting internet censorship to keep people from accessing sites like Google.

China is boosting internet censorship to keep people from accessing sites like Google.

Potential home buyers talk with a loan officer in Florida.

Potential home buyers talk with a loan officer in Florida.  Trading could be quiet Tuesday as a blizzard moves over New York.

Trading could be quiet Tuesday as a blizzard moves over New York.

The strong start for "American Sniper" was boosted by the Oscar nomination of star Bradley Cooper.

The strong start for "American Sniper" was boosted by the Oscar nomination of star Bradley Cooper.  The global economy is facing a 'sink or swim' situation now that central banks have done all they can to pump liquidity into the markets.

The global economy is facing a 'sink or swim' situation now that central banks have done all they can to pump liquidity into the markets.  ECB member Benoit Coeure (left) with Bank of England governor Mark Carney at the World Economic Forum.

ECB member Benoit Coeure (left) with Bank of England governor Mark Carney at the World Economic Forum.  Emma Watson is a celebrity spokesperson for the HeForShe campaign.

Emma Watson is a celebrity spokesperson for the HeForShe campaign.